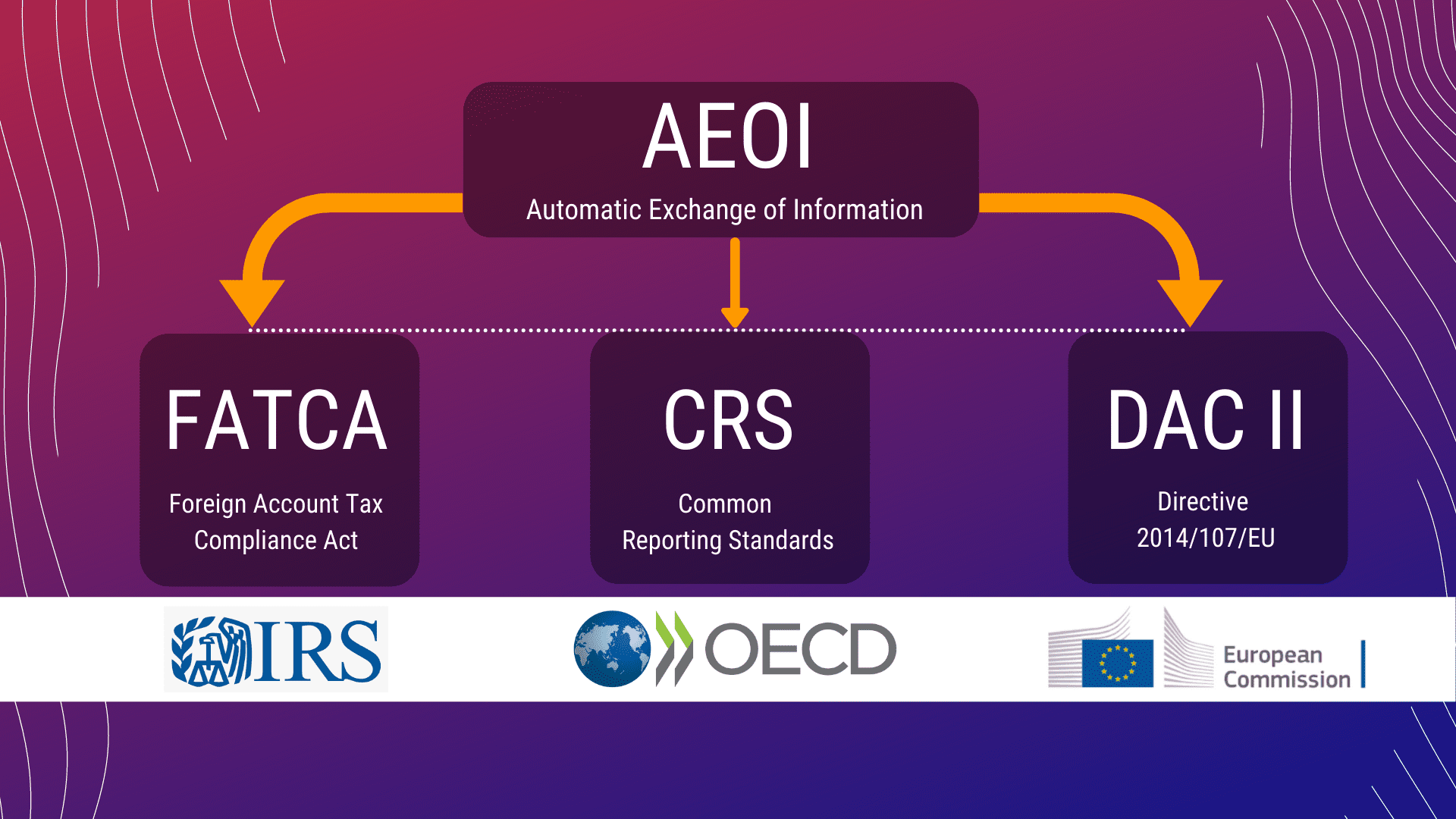

Automatic exchange of information gets closer with OECD's publication of global standard | International Tax Review

Common Reporting Standard: Survivor's Guide to OECD Automatic Exchange of Information of Offshore Financial Accounts - Eesh Aggarwal: 9781911236009 - AbeBooks

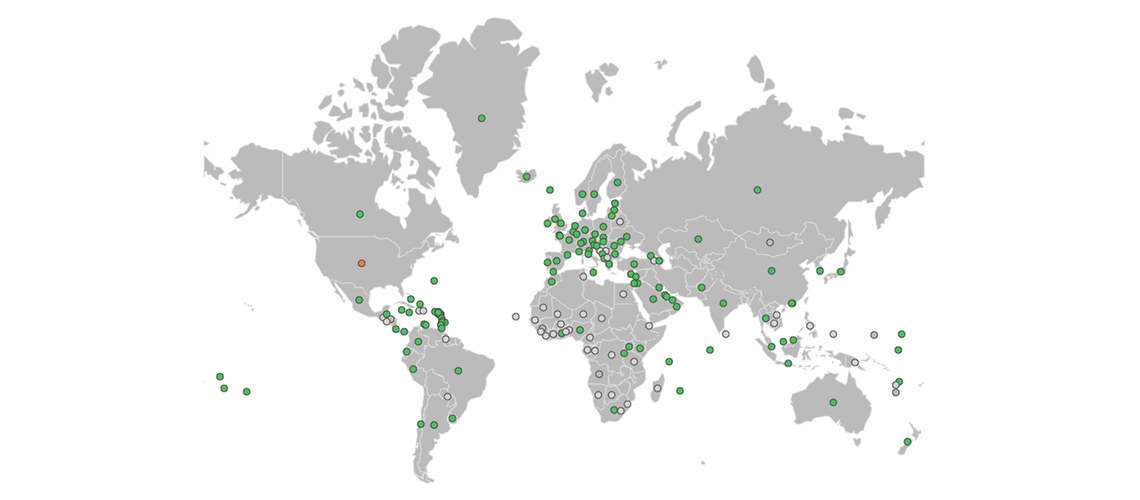

OECD Tax on Twitter: "What's the benefit of #AEOI? 9⃣0⃣+ jurisdictions have identified over €9⃣5⃣ billion in additional revenue through voluntary disclosure of offshore accounts, financial assets & income. Find out more

Automatic Exchange of Information: Survivor's Guide to the OECD Common Reporting Standard for Offshore Financial Accounts: Aggarwal, Mr. Eesh: 9781533519504: Amazon.com: Books

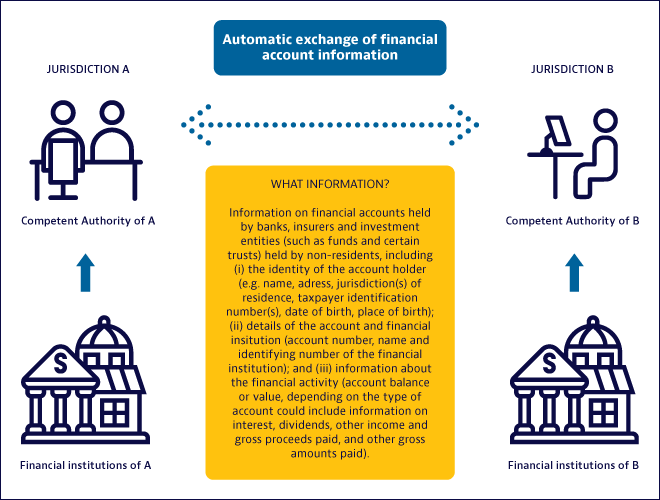

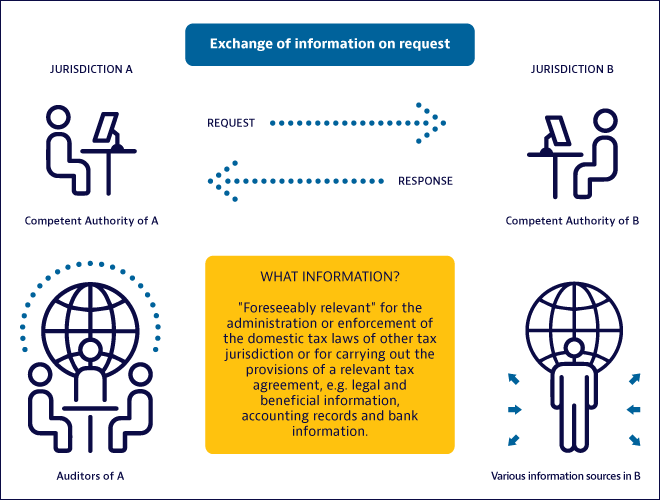

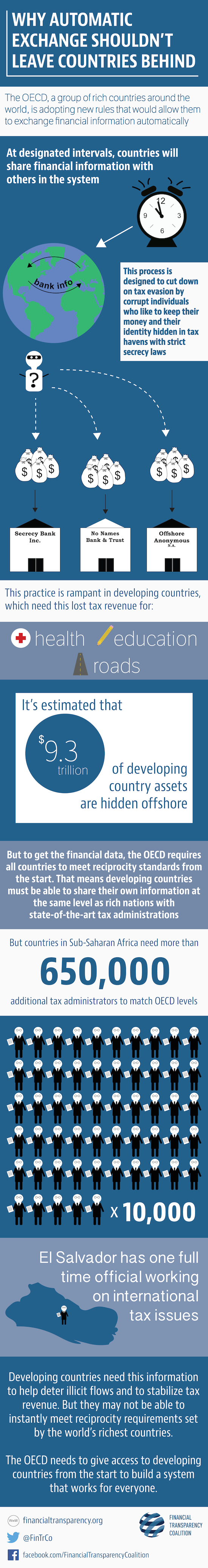

INFOGRAPHIC: Automatic Exchange of Information Shouldn't Leave Countries Behind - Financial Transparency Coalition

Automatic Exchange of Information: Survivor's Guide to the OECD Common Reporting Standard for Offshore Financial Accounts: Aggarwal, Mr. Eesh: 9781533519504: Amazon.com: Books

OECD Tax on Twitter: "The Global Forum just published its latest AEOI Peer Review which assesses 100+ jurisdictions committed to automatic exchange and (for the first time) includes ratings on its effectiveness

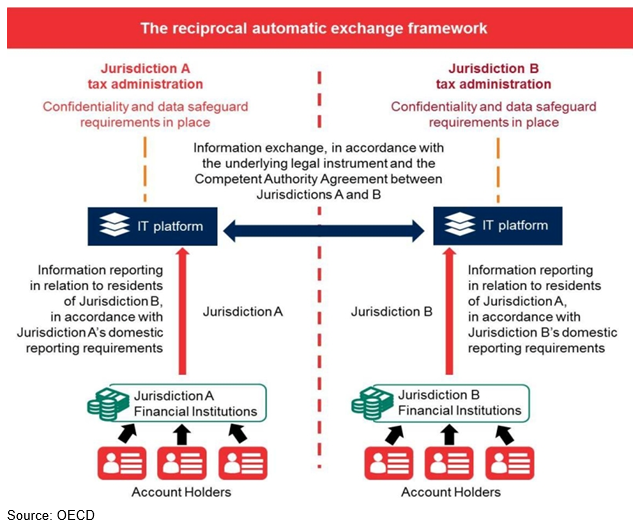

Standard for Automatic Exchange of Financial Account Information in Tax Matters: Implementation Handbook - OECD